January 2, 2026

The Rise of Big Data and The Fall of Follow-Through

When the term “Big Data” was introduced to the industry, there was a fever of excitement. Carriers and insurtechs compared cloud storage sizes to share that they were the leading companies in insurance analytics. But in actuality, big data is a series of spreadsheets that link to several data sources. These spreadsheets update automatically or when someone manually uploads a new data set.

As new risks emerge, capacity providers pull out of markets, and more books fall into runoff, the industry is at a precipice of opportunity or dissolution.

“The insurance industry is undergoing significant transformations in today’s rapidly evolving digital landscape. Data is the backbone of every critical function—from underwriting and claims processing to business development and regulatory compliance. Accurate and timely data is no longer a competitive advantage; it is an essential component for the longevity and success of insurance companies,” says Juliana Muir, Founder and CEO of Vellum Insurance.

Risk and Opportunity Move Faster Than Legacy Analytics Tooling and Workflows

(Re)insurers operate with legacy systems not designed to integrate with modern data sources, leading to data silos, where insights lie as unstructured and validated data in PDFs and spreadsheets.

“There is tremendously valuable data flowing through the industry today, but it’s lost with the simplest mistakes. Manual data entry, outdated records, and inconsistent data collection practices contribute to inaccurate and incomplete datasets.” Muir adds. “These issues are often exacerbated by the sheer volume of data insurance companies manage daily.”

Data Quality Holds the Secrets to Innovation and Profitability

Data quality is crucial for accurately assessing risk, setting appropriate premiums, and efficiently processing claims. Antiquated tooling cannot keep up with the evolving risk landscape. In order to innovate and accelerate growth, the industry must work towards a solution: collecting, standardizing, and aggregating data to deliver a solution for tomorrow’s risks.

“For too long, the industry has ignored the problem. In an industry where precision and insight are critical, poor data can lead to inefficiencies, missed opportunities, and costly surprises. Conversely, high-quality, well-managed data unlocks new possibilities: early trend identification, data-based decision-making, and opportunity detection.” Muir adds. “These learnings over my years in the industry led to the creation of Vellum.”

The Solution: A Software Built for The Industry

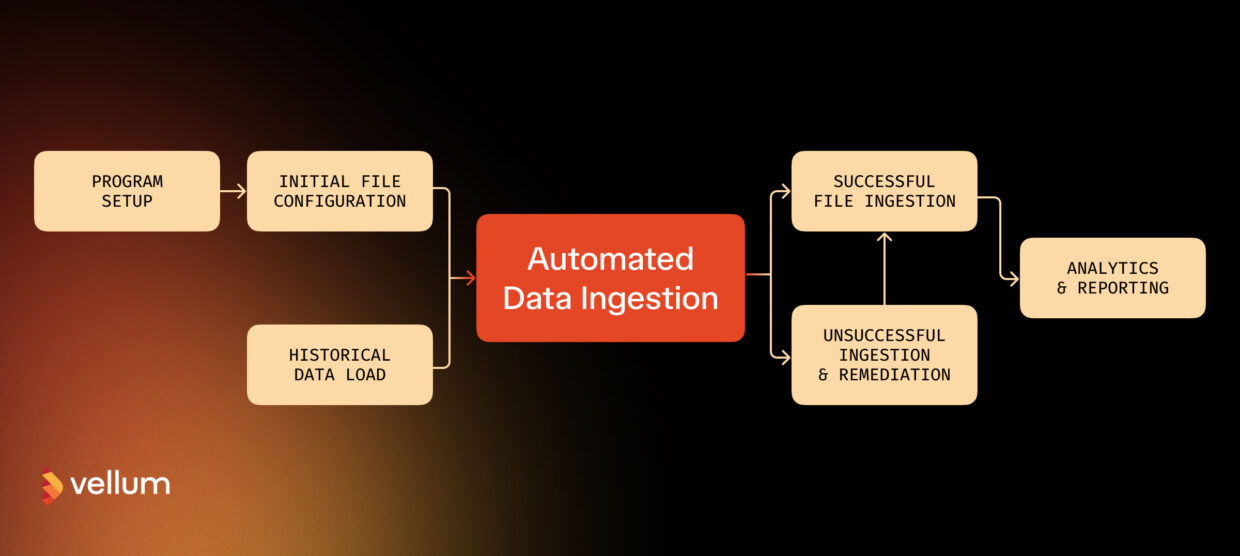

The Vellum platform first ingests, standardizes, and aggregates data, allowing insurance companies to spend more time analyzing spreadsheets and less time wrangling them.

The Vellum Platform provides out-of-the-box and customizable analytics that measure risk in real time, identify changes and trends, and allow our clients to take proactive steps to control the risk within their portfolios.

Read more related posts

January 6, 2026

Operations

Building Trust in the Age of AI: Why SOC Compliance Matters for Insurance

January 5, 2026

Operations

Not Just a Pipeline, A Promise: Vellum’s Principles of Data Stewardship

December 18, 2025

Industry Trends